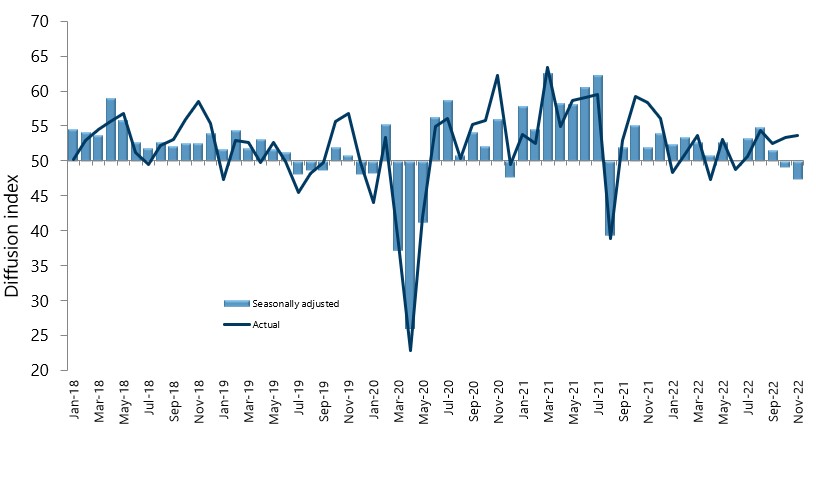

New Zealand’s manufacturing sector saw deeper levels of contraction in November, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

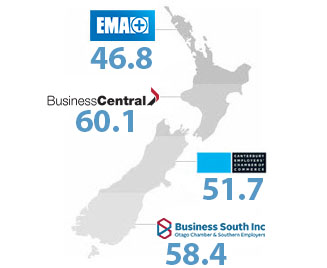

The seasonally adjusted PMI for November was 47.4 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 1.7 points lower than October, and the first time the PMI has shown consecutive months of contraction since the first nationwide lockdown in 2020.

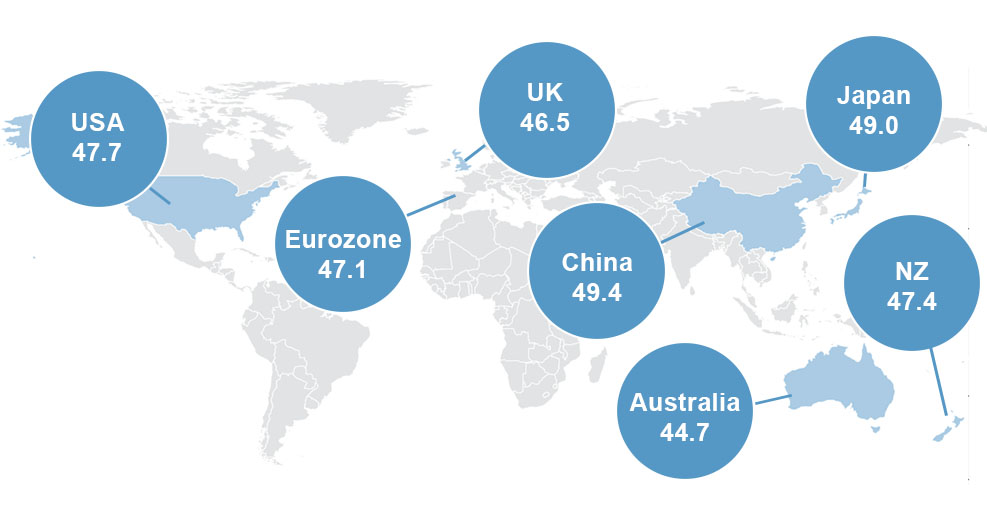

BusinessNZ’s Director, Advocacy Catherine Beard said that overall activity levels in New Zealand are now starting to mirror the global trend of contraction, which may indicate a tough start to 2023 for manufacturers.

“For the main sub-index results, New Orders (41.8) have now experienced three consecutive months of contraction, while Production (49.6) dipped slightly lower than the October result. Finished Stocks (56.1) continued to push upwards, while Deliveries (50.7) decreased 4.7 points from the previous month”.

Manufacturers have continued with a more negative mindset, with the proportion of negative comments at 58.4% for November. However, this was down from 61.6% for October and 61.5% for September. Manufacturers noted a general slowdown of conditions both domestically and overseas, as well as persistent labour shortages, particularly for skilled staff.

BNZ Senior Economist, Craig Ebert stated “it’s been quite the sag in the PMI, compared to just three months ago when everything appeared positive. Of course, the PMI can dive down to the 40-zone when things get recessionary. And November’s result wasn’t that awful. That said, it also had componentry showing a negative dynamic at play”.