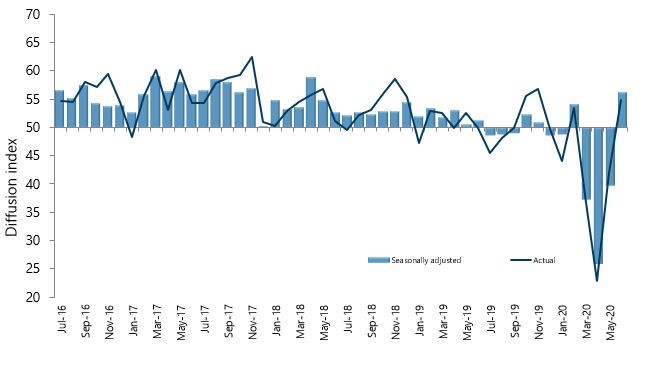

New Zealand’s manufacturing sector showed expansion for the first time since February, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

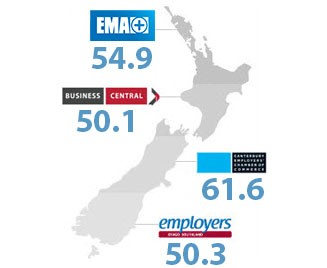

The seasonally adjusted PMI for June was 56.3 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was up 16.5 points from May, and the highest result since April 2018.

BusinessNZ’s executive director for manufacturing Catherine Beard said that a return to expansion for the sector was obviously a welcome result given the very difficult period experienced over the last three months. However, given the path towards recovery has simply meant trying to get back to standard operational levels for many, it was just a matter of time before the sector would be back in black.

“Leading the way were the key indices of production and new orders (both at 58.6). Like the main result, these were at the highest level of expansion since April 2018.

Overall, we should remain cautious that one expansionary result does not represent a trend given ongoing offshore uncertainty around COVID-19. A consistent trail of new orders over the coming months would go a long way towards ensuring the second half of 2020 is better than the first.

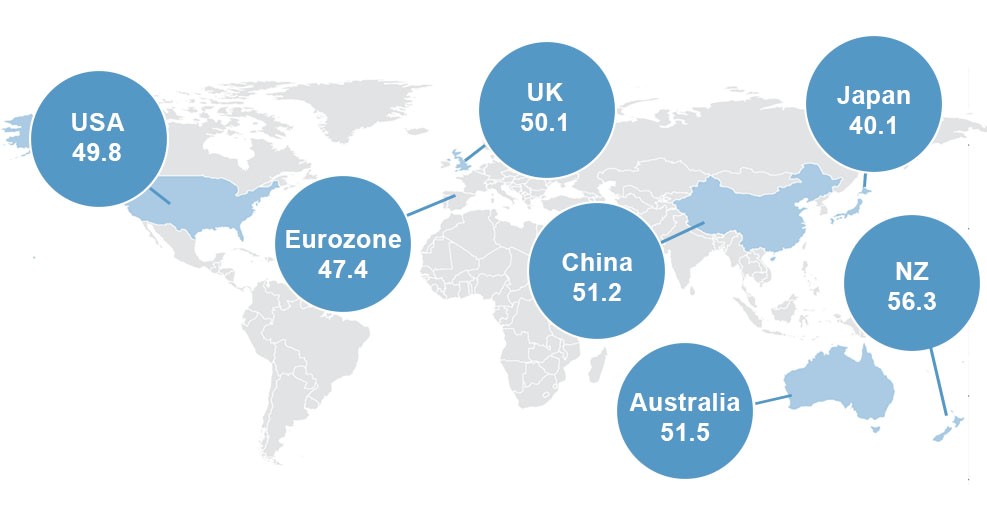

BNZ Senior Economist, Doug Steel said that “New Zealand’s PMI average through April and May was at the bottom when looking across usual comparator countries. But with the country at alert level 1, activity has picked up. Long may it continue”.